Are you ready for a blast of optimism in a bleak landscape of dire real estate news?

If you listen to the national mainstream news and a lot of real estate agents right now, you might think the sky is falling and real estate is crashing. We are bombarded with that message day and night.

And yet, there are so many reasons to be buying right now. Let’s start with the opportunities, and then weigh the risks of getting off the sidelines.

Current Opportunities

Yes, we all know that mortgage rates have more than doubled in a very short time. This resulted in a whole lot of buyers freaking out and ditching their buying plans.

At the same time, sellers were just starting to get the memo about it being a good time to list and starting to put their properties up for sale.

The result has been more listings with fewer buyers competing to buy. This inevitably resulted in prices softening.

If you’re a buyer, what’s not to love about more choices, softening prices and room to negotiate?

That is the opportunity.

Current Risks

I see two primary risks. One is that prices go lower (leading people to fear overpaying), and the other is that monthly payments are no longer manageable at today’s rates.

Will Prices Tank?

Let’s talk about prices. There are markets in our country that hugely overheated due to a combination of low interest rates and changing workplaces. Boise, Austin and Phoenix come to mind. These and a few other cities always get mentioned when the word “bubble” comes up.

The Street published an article last week gauging the risk of a property bubble in 25 cities around the world including five in the U.S. The cities were ranked as a “bubble risk,” “overvalued” or “fair valued.”

Nine cities, none of which are in the U.S. were tagged as bubble risks. In the U.S., Miami, LA, San Francisco, Boston and New York were tagged as overvalued.

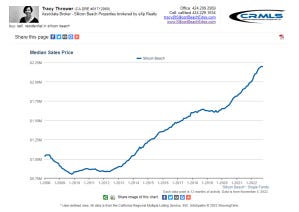

But let’s talk about LA. It’s huge and is a story of micro-economies. Our beach cities felt quite frothy over the last few years, but if you look at the graph below, our upward trajectory has been consistent for the last 10 years.

We took a 20-25% hit as a result of the 2008 Great Recession, but that particular event was the direct result of poor loan underwriting and thin equity positions in real estate, along with a whole lot of fraud. Real estate caused that recession.

Our current challenges are not real estate driven and, in fact, real estate has performed beautifully through our once in a lifetime health pandemic. We have record amounts of equity in our homes and underwriting standards have been very stringent, resulting in very little foreclosure activity.

There just isn’t any reason to expect a drastic drop in home prices in our beach cities.

But Can I Afford The Higher Rates?

The sudden bump in rates is definitely making payments for 30-year fixed mortgages higher. Queue the people with the out of box ideas to get around these higher payments.

Idea number one! Shift your home search to a less expensive area if you’re intent on buying with a 30-year fixed rate. Or, buy a smaller house with growth potential in your target community. Both will appreciate over time and make you money.

Another idea for risk-averse people intent on 30-year fixed mortgages is the rate buydown programs. Newsflash! The seller might even be willing to pay the fee.

Or if you have a little more appetite for risk, look at adjustable rate mortgages. The risks are very manageable. I wrote about ARMs here and here.

The bottom line for managing interest rates right now is that you have to make up your mind to find a way and start a conversation with a lender and agent to explore options.

Should I Wait For Lower Rates?

This question comes up a lot and cracks me up! When rates go down, there will be a lot of pent up demand among all the buyers asking this same silly question. When rates go down, tons of people will come back into the market and prices will go up again.

Real estate is almost always a story about low rates and high prices or high rates and lower prices.

Right this minute is your chance to get in on the softening prices and either hack the rates or suck up on the rates and re-fi later.

A Note To Cash Buyers

If you’re a cash buyer or mostly cash buyer, you absolutely should be buying now while mortgage buyers are on the sidelines figuring things out. Will prices go lower? Maybe they will soften a little more (or maybe they won’t), but that graph above should tell you that over the long haul, your investment will be sound, even if you leave a few bucks on the table now.

Final Thoughts

Whether you are a mortgage buyer or a cash buyer, right now is your opportunity to buy without as much competition. For mortgage buyers, take the higher rate now and refinance it later. Don’t wait for everybody to come back into the market and drive prices back up.

And by the way, I’ve seen a huge uptick in buyer inquiries in recent weeks. Buyers are getting hip to the fact that no matter how gloomy the rate picture is, now is indeed an opportunity. Do not delay. Get your ducks lined up and let’s go see some properties.

For other ideas on hacking high rates, read my recent article outlining nine interest rate hacks. Still think you should wait? Read 3 Data-Driven Reasons To Buy Right Now.

And if you still have doubts or questions, join me for digital office hours on Sundays and Thursdays to ask me your hardest questions.

This post is from our “Buyer Edge” series, content designed to give real estate buyers in Silicon Beach an edge in a competitive residential real estate market. Read more about our full Buyer Edge program on our website. Want help buying real estate in Silicon Beach? Contact us, grab time on our calendar or read more Buyer Edge articles. Need help beyond Silicon Beach? Reach out and let us help you find a high-caliber agent with hyperlocal expertise in that area.

Homes in Venice on the market today with backyards – https://t.co/gG8LKqtnIo. #nationalpitbullawarenessmonth #loveabull #teamedge #siliconbeach #siliconbeachrealestate #siliconbeachrealtor #siliconbeachproperties pic.twitter.com/o9vzdgcHU5

— Tracy Thrower Conyers (@TracyTalksReal) October 30, 2022