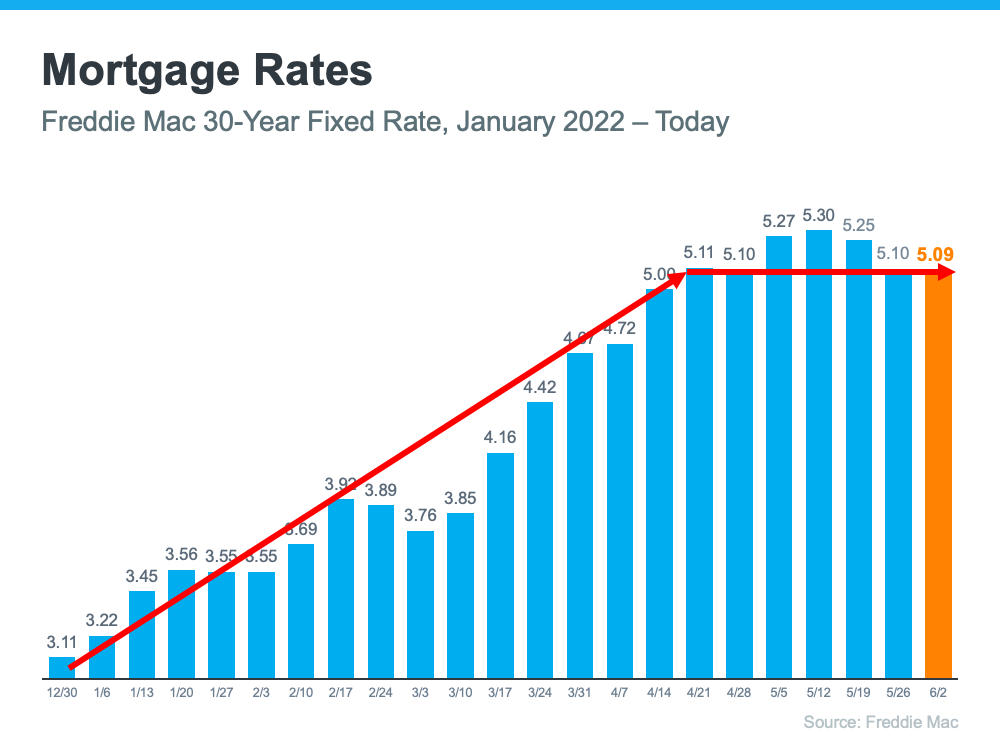

2022 is flying by in a blur! Can you believe we started the year with mortgage rates a hair above 3%? It's been a year...

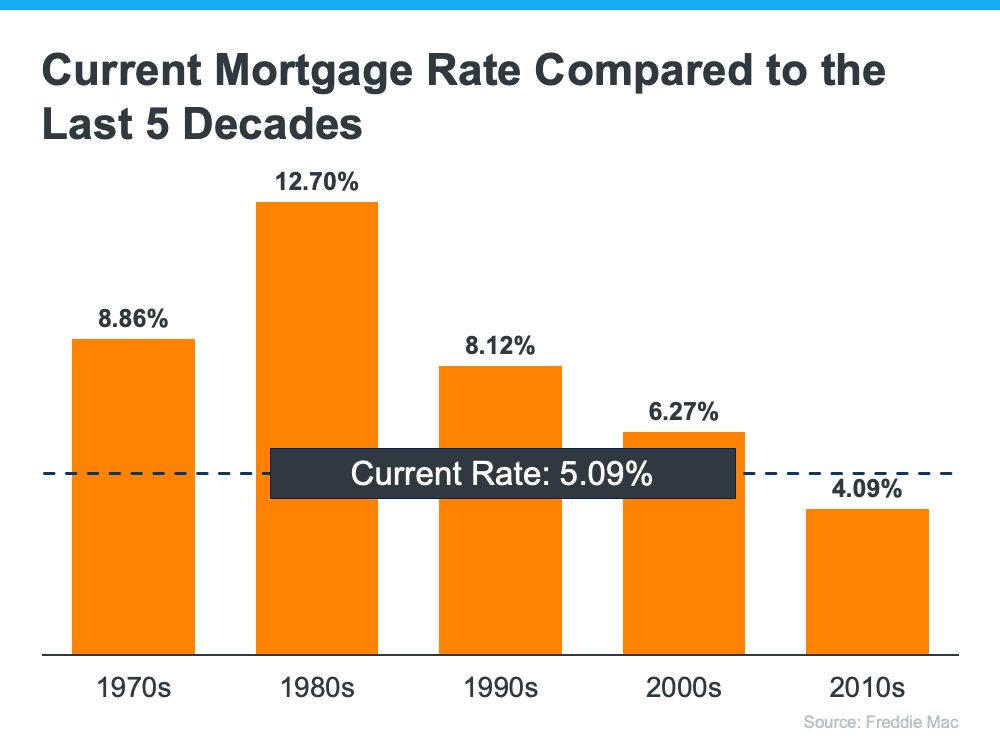

The good news is that our relentless rate hikes appear to be plateauing. While we may all be wishing for the "good old days" of January, in the bigger picture, our current rates are lower than rates in the 2000's, 1990's, 1980's and the 1970's. This really is good news. Ignore the clickbait headlines offered by the mainstream media.

Will There Be A Crash?

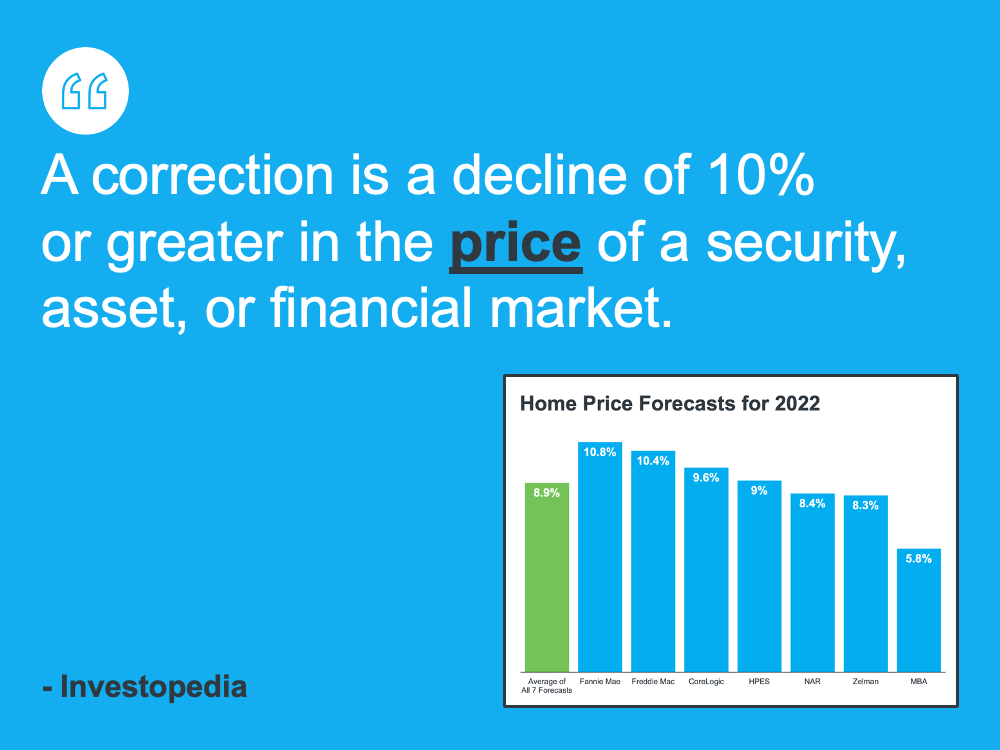

The mainstream media certainly thinks housing is headed for a crash. My favorite YouTube commentator is off the rails with his dire predictions, but thankfully, the data tells a more reasonable story.

In fact, we're not even in "correction" territory, defined as a 10%+ decline in values. Seven highly respected housing commentators all agree that home values in 2022 will increase on average 8.9%.

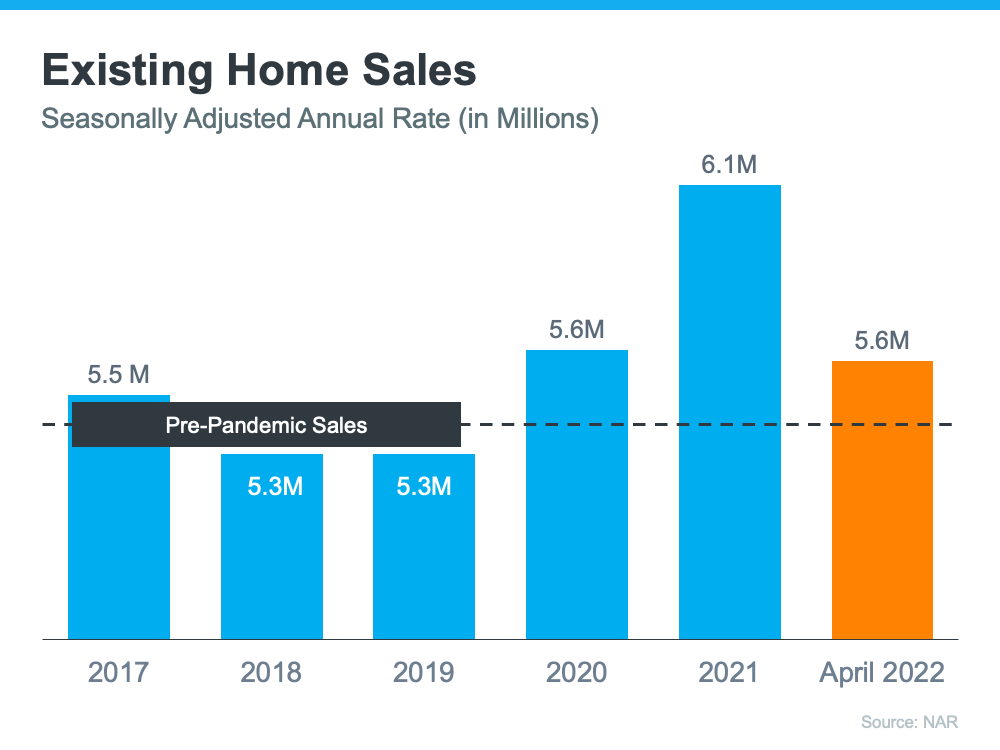

What we're really seeing is a simple return to pre-pandemic times with extra demand fueled by millennials coming into their house buying years.

Listings are sitting on the market nationally for 17 days, which is considered a very hot market. Here in Silicon Beach, our days on market statistic is more like 10 days! Multiple offers are still the order of the day, with three offers being the California average. Sellers are still very much in charge, but with more inventory coming on the market, sellers are starting to reduce some of their overly aggressive list prices.

In short, experts don't believe the market is in bubble territory or that a crash is in the cards like we saw in 2008. We don't currently have enough housing and we have very high demand. This is not the stuff crashes are made of.

What About A Recession?

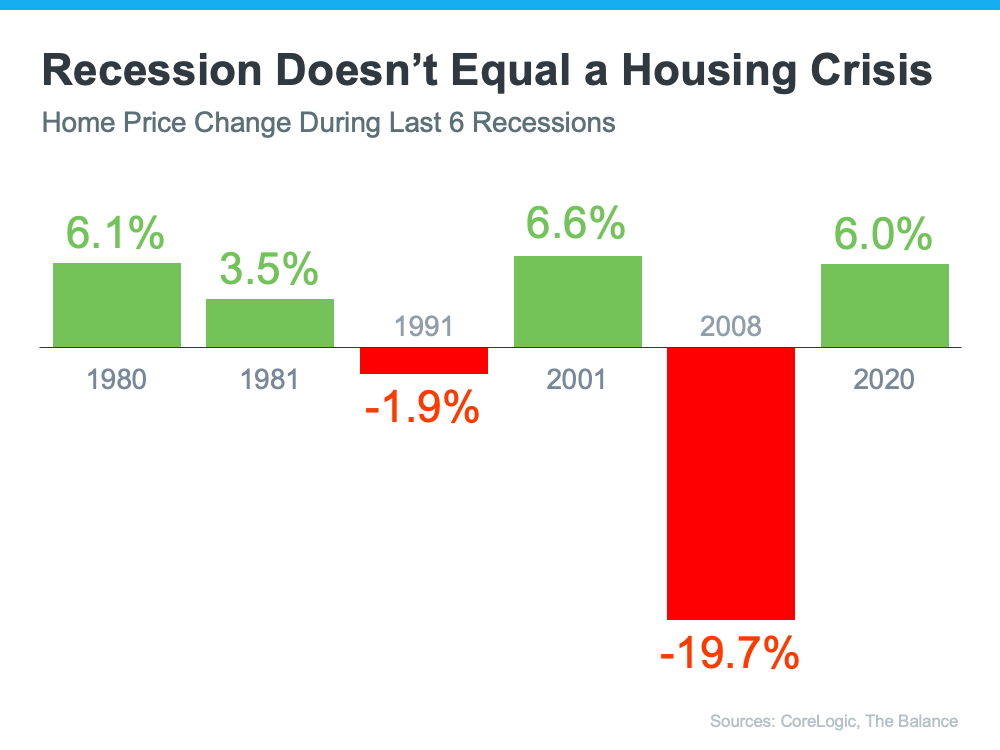

Even if we find ourselves in a recession, housing generally fares well.

The graph above stretches back to the 1980's and housing has increased in four of the last six recessions, with the 2008 recession being a radical outlier because that recession was specifically caused by massive fraud in the housing sector. Lending standards are very rigorous today and homeowners have not been spending all their equity.

In short, if you are considering buying, there is no reason to believe home prices will stop appreciating. This means prices are going up, not down. If you wait, you'll pay more.

If you're considering selling, your pool of buyers shrinks with every rate hike. And most sellers are also buyers. Waiting doesn't benefit you on your buy side, either.

Want to chat about what all this means for your specific situation? Pick a convenient time on our calendar and we can meet by phone, by zoom or IRL, or drop by our zoom office hours.

PSA! Who your agent is matters! I don't care if that agent sold 100 homes last year or has been in the business for a hundred years. Whether you're a buyer or a seller, you need an agent who obsesses over data trends and pricing in our current volatile market. For sellers, you also need an agent who can make your listing stand out in an increasingly noisy space and get it in front of the most eyeballs. This is your ticket to the highest price on the terms you want.