20 years ago, my husband and I bought a house together. We were newly married, living with five cats in an apartment and expecting a baby. This was long before I was selling real estate, but we had a real estate agent and mortgage lender we trusted implicitly, so we forged on and ended up in a cute little bungalow in Westchester, with escrow closing just as our baby was born.

A year or two into home ownership, I was looking through some files and found our loan docs. I was thumbing through and noticed that our 2nd trust deed secured an adjustable rate mortgage. 😳

I'm not going to lie. That word "adjustable" freaked me out. For whatever reason, I wasn't aware we financed with an ARM. Yes, sometimes one can trust their professionals a little too much, so take care in picking them in the first place. 😁

I started reading the terms and was intrigued. It turned out our ARM was fixed for 10 years and adjustments were spelled out specifically and capped at a certain amount. The terms were a lot like our fixed rate first trust deed. I did a little math and quickly realized we were many years away from ANY adjustments and when we got there, the adjustments would be modest.

I promptly stopped thinking (read "worrying") about this loan. Fast forward a few years later and we refinanced into new and better loans.

We haven't heard much about ARMs since 2008 when they got a very bad rap because they were given to unqualified borrowers who didn't understand what they had. Rates have come down quite a bit since the Great Recession and most people post-recession borrowed with fixed rate loans. ARMs pretty much fell off the radar.

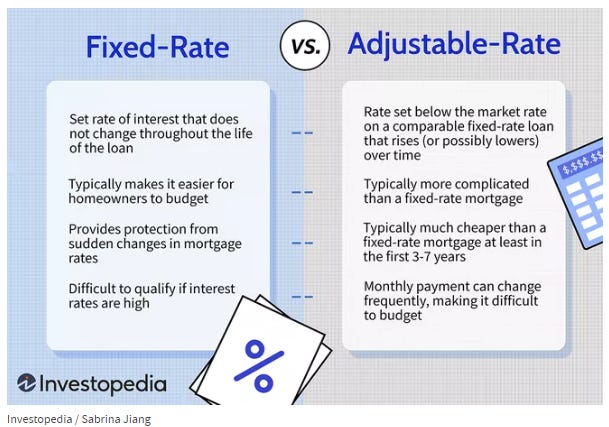

More recently, as rates started creeping up again, lenders started talking again about ARMs. Why? Their rates are somewhat lower than a fixed rate product and people want lower priced options.

So, why are ARMs cheaper than fixed rate loans?

Mortgage rates are a story about risk. If a lender is stuck with you for 30 years, they want to make sure it's going to be at a rate that "works" for them for the long haul. ARMs are considered shorter term loans with less term risk, so they're priced lower. If the lender has to keep your loan on their books past the short term fixed portion of the loan, they will be compensated with an interest rate bump.

Fun fact! ARMs can adjust down, too.

The most important thing to understand about ARMs is to understand your terms and to make sure you're making tweaks over the life of the loan that make sense. Pencil out your contractual rate adjustments and make sure you retire or refinance the loan before the adjustments kick in, or make sure you understand the adjustments and their impact if you leave the loan in place.

Learn the ARM lingo in this article. Read more about ARMs in this Freddie Mac article.

One lender I work with is offering five year ARMs at 4.75% and seven and ten year ARMs at 5% vs. the current 5.85% fixed rate.

Our economy and interest rates are cyclical. Rates are up now and are projected to drop in the next year or two. If you are nervous about a five year window closing too fast, consider the seven or ten year ARM to fix your rate for more time.

The bottom line is to talk to your lender about the terms you might get with an ARM and understand them. They aren't complicated and a good lender will explain them. Don't ignore the ARM option simply because uninformed people criticize it.

If you just can't wrap your brain around the idea of something that will adjust and are intent on a fixed rate mortgage, another strategy to save money is to consider paying points upfront to bring down your rate. This is another strategy that requires a conversation with a lender for the details and running some numbers.

Pro tip! If there isn't much competition for the house you want, you might consider asking the seller to pay the points. This is out of box thinking, but not out of the question. It depends on the seller's level of motivation to move the house and it might involve having to explain the concept to the seller's agent. 😁

Need a lender recommendation? We work with lenders we love and think you will, too. Text the word LENDER to 424.228.9969 and we'll send names and contact info.

If you like the idea of working with a buyer's agent who keeps up to speed on strategies to help buyers get the best deal on properties they love, consider working with us! No obligation conversations can be scheduled using this link.

*A note about my blog title. Being a woman of a certain age, I was so very sad to see the news this week about Olivia Newton-John's passing. I'm sure you can see what I'm going for with my tribute. 😁

This post is from our “Buyer Edge” series, content designed to give real estate buyers in Silicon Beach an edge in a competitive residential real estate market. Read more about our full Buyer Edge program on our website. Want help buying real estate in Silicon Beach? Contact us, grab time on our calendar or read more Buyer Edge articles. Need help beyond Silicon Beach? Reach out and let us help you find a high-caliber agent with hyperlocal expertise in that area.

We’re very social. Come find us!

By Tracy Thrower Conyers

Tracy is a realtor specializing in Silicon Beach, with a hyper-emphasis on Venice, Westchester & Manhattan Beach. She is a past practicing attorney & real estate tech founder. Tracy is an early adopter of all things digital and 20-year real estate industry vet. She's been quoted on topics of Silicon Beach real estate by trusted media outlets including the Los Angeles Times, KCET and The Argonaut.