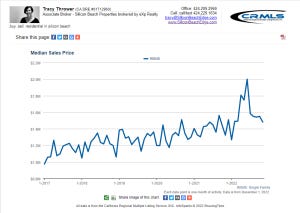

The monthly MLS data dropped a couple days ago and I noticed an interesting phenomenon when looking at the numbers for Westchester single family home prices. Below is the chart showing median price month over month.

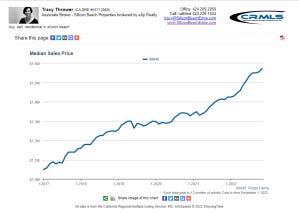

Looking at that chart, you might think Westchester prices were in a free fall. Certainly if you watch any kind of mainstream national news, your conclusion would have been validated. But consider the same data on a 12-month rolling average:

Does that second chart read like a free fall? How does one even reconcile such seemingly different stories? My take is that even though we’ve seen a lot of downward pressure on prices since June, we haven’t given back all of our twelve month gains.

So Tracy, how do you know we won’t? Maybe we don’t know how the story ends.

My response to you is that second graph above goes back five years and it’s pretty darned consistent.

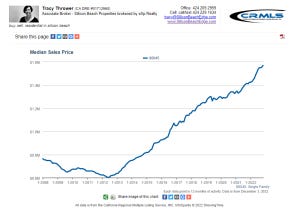

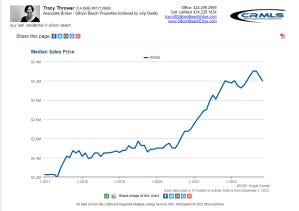

I can also look at data all the way back to 2008:

Although we had a bit of a bumpy road following the Great Recession of 2008 (and don’t forget that recession was caused by real estate fraud), the story since then has been nothing but full steam ahead and up for the last 10 years.

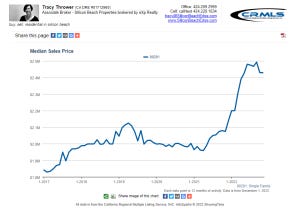

Venice and Manhattan Beach each show a pull back on their 12 month rolling average price charts, but these drops are on the order of 2.5% to 3%, and certainly don’t constitute any kind of free fall.

Click on any of the graphs to open dynamic charts. You can read the price for each month and the charts will update over time.

Whether you’re buying or selling real estate in our beach cities right now, we are not experiencing any kind of fire sale, despite what the national media says. They like to compare periods that make for the most dramatic headline, not make sure you get the full story to make good investment decisions. For that you need your hyperlocal real estate expert.

Each community has its trendline and it’s important to understand what that trendline is as you consider buying or selling real estate in any of our beach communities. Work with an agent who understands the trends.

Any way you slice it, prices in our beach cities are not in any kind of free fall, and are not likely to find themselves that way any time soon. We’ve lived through unprecedented times in the last three years and crazy things happened in real estate. If we have to give back some of the crazy gains since early 2020, so what?

Who really thought 30-40% price gains were going to be sustainable?. We are feeling out our new post-global pandemic normal, but there is no reason to think we won’t get back to our pre-COVID pattern on consistently rising prices, even if at a more tempered speed.

Are you screwed if you bought in the last three years? Over time that price chart just keeps marching upward. They aren’t making any more land in the beach cities. Hopefully you can sit tight for five years and enjoy a gain.

Or if you’re like my family, your five-year home becomes your 20-year home because you never got around to moving and you see a dramatic amount of appreciation.

Either way, I’m rooting for you!

Who wants to talk about the trendline in their target community? Grab a time you like on my calendar at this link, and let’s chat. You can also drop into my zoom office hours on Thursdays and Sundays to ask questions. More information about digital office hours at this link.