Buyer fatigue got you down? Nobody would blame you.

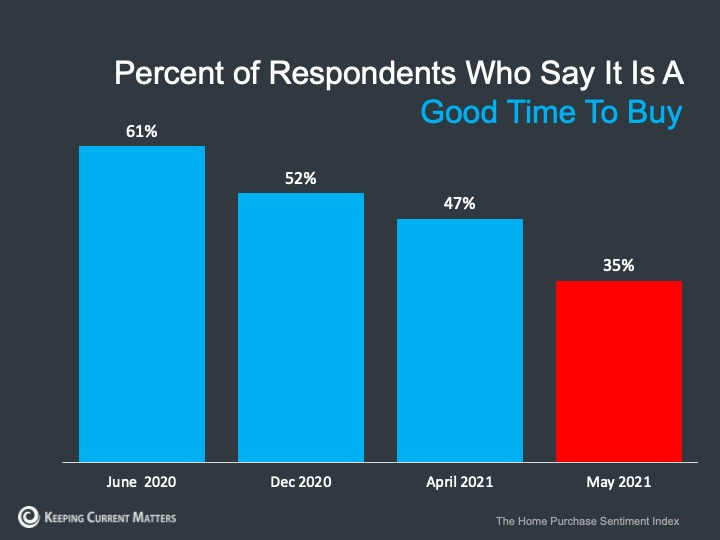

Fannie Mae recently released its monthly Home Purchase Sentiment Index (HPSI) numbers, noting that for the second consecutive month, consumers "reported a significantly more pessimistic view of homebuying conditions" with only 35% of respondents believing it's a good time to buy a home.

Those kinds of numbers make for some really scary clickbait headlines. Just type "real estate bad time to buy" in google and up pop 798 MILLION results, including my not so favorite When Is The Los Angeles Housing Market Going To Crash? from Forbes, a highly trusted source for personal financial news. Even though that contributor concludes a crash is not coming, he just couldn't resist the clickbait title.

But hey, I’ve been known to use it myself.

Buyer Fatigue has been attributed to no less than 7 different sources:

record high median prices

record low inventory

record high % sales over list price

record low days on market

record low mortgage rates

half of the houses in the month preceding the noted HPSI went pending in a week or less

19% of homes sold in that same month had their appraised value come in below the offer price in the contract

So much to wring your hands over, right?

Maybe. Maybe not.

I'm not saying it's not tough out there for buyers. In Westchester's super sellers market, for example, buyers are getting creamed. And this is exacerbated by not having a clever buyers' agent totally plugged in on getting offers accepted in competitive environments. Who your agent is has never been more important. There are strategies for dancing with the challenges and good agents are studying up because these are unique times.

So yes, there are some real life stories to support the national headlines and buyer sentiment is consequently down, but I’m here to say in my sweetest tough love voice “shake it off.” When other buyers drop out because they believe the clickbait, I just see more opportunity for my clients who stay in the process. Fewer buyers is good for buyers.

Rising prices today means more equity tomorrow, but only if you jump in. Mortgage rates are situationally low and won't stay this way. In fact, chatter surfaced this week that the fed may raise rates sooner than expected to combat inflation, and mortgage rate hikes will come even sooner.

And fatigued buyers will come back to the market. Why? Because real estate still represents a great opportunity to build wealth, especially here in Silicon Beach, where they aren’t making any more land and the economy is robust. This is a short-term opportunity to take advantage of the buyer fatigue that all the frenzy in the headlines.

So, shake it off and let’s get shopping! Who wants to see houses? 🙋♀️🙋♂️ Schedule time on my calendar so we can come up with a strategy and let’s get going before those other buyers jump back in.