Spiraling home values, soaring inflation and increased interest rates are three huge reasons to buy right now. The house you can afford today will likely be out of reach tomorrow. Prices are not coming down anytime soon, even with these other factors weighing down the sector. Read on for the deets.

1. Increased Housing Prices

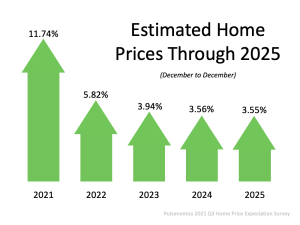

Consider this graphic of estimated home prices through 2025 from Pulsenomics, an independent research and index product development company:

To put this graph in practical terms, a home priced at $1M in January will be worth $1.1174M by the end of the year. That home cost you almost $10K every month you waited to buy it. 😲

Pulsenomics is predicting that foot will come off the accelerator quite a bit in the following four years, but here is how much that same home goes up every month in each of the following years:

2022 → +$5419/mo.

2023 → +$3882/mo.

2024 → +$3646/mo.

2025 → +$3765/mo.

By the end of 2025, that humble $1M home is worth $1,317,958!

That would be daunting even if interest rates and inflation stayed the same.

And don’t forget that housing prices in our beach cities are very specific to each community. Manhattan Beach is up an eye popping 15% in the last 12 months. Text us at 424.228.9969 with questions about your specific target community.

2. Increased Interest Rates

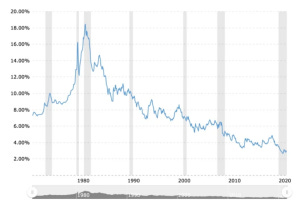

There is no question that interest rates have been held artificially low by the Fed to stimulate our economy in connection with the pandemic. It is likewise indisputable that we want interest rates to rise because rising rates are a sign of a strengthening economy.

Where does this leave real estate buyers?

There are two impacts. First, you’ll pay more interest on the loan. Second, it will be harder and harder to qualify for higher rate, more expensive mortgages.

The concept of rising interest rates is kind of foreign to us. With the exception of a tick up in rates from July 2016 to October 2018, rates have been consistently trending down since 1987, hitting an all-time low in December 2020 at 2.67%. Who remembers those rates from the 80’s?? 🤯

In their latest quarterly forecast, Freddie Mac economists predict rates on the 30 year fixed loan will rise from that low of 2.67% to 3.7% by the end of 2022.

One percent doesn’t sound like much, but it can cost a buyer on a $1M loan approximately $75K over the first 10 years.

But forget the added cost. The real problem is qualifying for the more expensive loan. Wages are not keeping up with this kind of interest rate bump.

3. Increased Inflation

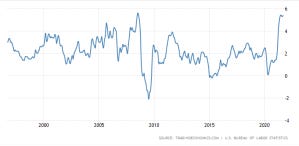

We haven’t seen inflation like we’re seeing now since 2008:

According to TradingEconomics.com, inflation is up from 1.2% in October 2020 to well over 5% today.

Think of inflation as yet another tax on your income. If you make $100,000/year, 5.3% inflation makes your $100K worth only $94,700. 😢

Final Thoughts

But wait, won’t these factors cause prices to come down?

Pricing is all about supply and demand. As some buyers are priced out of the market, the buying pool shrinks and prices are impacted, but there will continue to be plenty of demand in our beach cities. Buyers might have to bump down to their second choice neighborhoods, but there will still be lots of buyers still trying to lock in 3.7% rates before they become 4.7% rates.

Bottom line, while purchasing today might mean compromises, the cost of waiting is so substantial that it’s better to transact now and enjoy that the equity gains still left to enjoy. Unless you own your current home, you’ve already missed most of the 11.74% for this year. Don’t miss next year’s 5.82%, also.

If you have a house to sell before you buy, don’t wait for that either!! As the buying pool shrinks, there will be fewer buyers fighting over your property. More buyers always means more a better outcome for sellers, whether that is terms or dollars or, hopefully, both. More money for your current house means more money to buy your next house.

Your Next Steps

We are here to help you strategize your highest and best outcome. Please take advantage of our no obligation 30 minute consultation by booking a time here. If you want something even less formal than a casual meeting, take advantage of our digital office hours where we man a zoom meeting for drop in’s. On Sundays between 10am and 1pm or Thursdays between 10am and noon (pacific time), join us via www.SiliconBeachZoom.com. It’s getting crazy expensive to wait. Let us help you with a strategy to get your move on now.